Yep, and they are all mainly caused by credit expansion. Blame the FED

Well for the obvious reasons of capitalist regime I can't blame FED for credit expansion.

Credit expansion has to happen to keep perpetual growth year after year without ever decreasing....

I just had to paste this to keep laughing more and to have fun...

The consumer is essential for Capitalism. The US economy is driven all most entirely by consumption. Not only must consumers buy, they must buy more every year, and still more the year after that. Without perpetual consumption, the economy would either decline or collapse.

80% of America’s $14 trillion economy is service based. Wholesale trade, the manufacturing of consumer goods and retail comprise 65% of the services sector. The US over the last 30 years has become reliant on consumption and today is the world’s largest consumer of many items.

Dr. Lorrin Koran, a professor of psychiatry at Stanford University and expert in

behavioural Science said “Its not just individuals who are addicted to shopping, our economy is too. Personal spending now plays a bigger and bigger role in keeping the modern economy going. And when things start going wrong, there is no magic pill. Governments rely on consumers to bail them out. There was a very real fear that September 11 would cause spenders to lose confidence and plunge the world into recession. Keeping people spending has become the top economic priority.”

The importance of the consumer to consume to the US economy was outlined by Richard Robbins expert in anthropology in his award wining book ‘global problem and the culture of capitalism,’

‘a couple of days after the al Qaeda operatives crashed two planes into the world trade centre on September 11th US congress members met to plan a message to the stunned public. “We’ve got to give people confidence to go back outside and go to work, buy things, go back to the stores, get ready for thanksgiving, get ready for Christmas,” said one member of congress, echoing the message of the president ‘get out’ he said “and be active members of our society.” (CNN 2001). ‘The fact that after one of the most shocking events in US history government officials were urging citizens above all to shop and work is ample testimony the significance of consumption in the effective working of our economy and indeed for the whole society.”

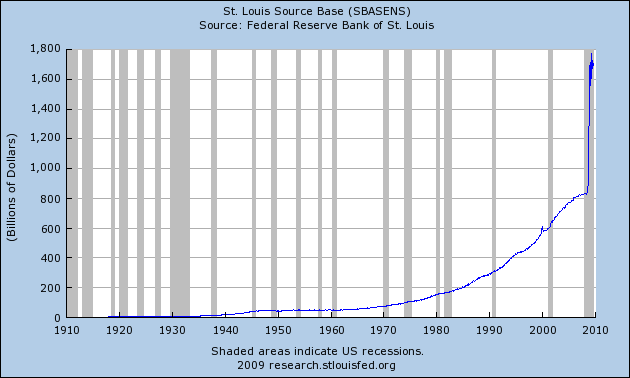

The events of 9/11 and with the prospects of a recession in the US, the federal reserve in cahoots with the white house reduced interest rates to virtually 0%. This made debt an attractive way to fund spending with little interest to be repaid, this also meant monthly mortgage repayments had little interest added to them.

This housing bubble is what drove the US economy since 9/11 as a large chunk of consumer spending went on the purchase of homes. Housing in turn fuelled appliance sales, home furnishings and construction. In 1940 44% of US citizens owned their own homes, by 1960 62% of Americans owned their homes. Currently nearly 70% of all housing is owned by its constituents. The increase in home ownership resulted in more and more US citizens becoming indebted, US household debt stood at $11.4 trillion in 2006.

When the housing bubble burst due to the huge increase in defaults, this essentially brought to an end the engine that drove the US economy for the last decade. This spread to the rest of the world as the US is the main engine for economic activity for the world economy. Its huge level of consumption is responsible for most of the growth being experienced by China and India. With only 5% of the world’s population the US consumes 25% of the world’s oil and imports 9% of all goods manufactured outside its borders.

With consumption playing such a key role in the functioning of Capitalism, people havecome to be symbolised by what they wear, eat and drive. Hence sensual gratification has become life’s aim and with the dwindling world resources and ever increasing numbers competing for sensual gratification greed has come to characterise Capitalist societies. Capitalism believes if individuals in society pursue their self‐interests then the right resources are produced for those who want them and this is the best way to allocate resources.

Today self interest (greed) is considered a necessary trait for the 21st century individual; its

corruption can now be seen across society. Greed is the motivation that led to predatory

mortgage brokers selling mortgages to people that have no way in paying it back, and then

increasing the rates of interest until the buyer defaults. Greed was also the motivation that led

the credit ratings agencies to rate the investments less risky than they really were, and also to

conceal that the risk was based on sub‐prime mortgage debt. Hedge funds demonstrated

greed in the way they seek to provide astonishing returns to their customers, and greed is the

motivation even for individual shareholders that want to capitalise on the falling share prices

across the economy, even though it can lead to problems for thousands of people. The effect of

this is devastating; since each element within society puts their benefit before ethics and

morals, this is why we have a situation where even if the effect of an investment decisions can

lead to a downturn in the economy, companies are prepared to make those decisions anyway.